Beyond meat and milk

Three scenarios show us how the rise of

new proteins could radically change the

future of farming in Aotearoa

Increased global demand for alternatives to animal proteins could significantly impact farming in Aotearoa New Zealand – for better and worse.

The rise of new ways to produce protein could upset the economics of milk and meat products, the structure of farming sectors and the New Zealand farming landscape, while bringing environmental benefits. The Protein Future Scenarios research project aimed to define the possible future impacts on Aoteaora New Zealand from increasing global demand for alternative proteins.

New Zealand needs to prepare for significant changes to our key food export markets, found the research.

Alternative proteins are likely to significantly affect the global market for proteins, as food technology improves and diets change in response to concerns about climate change and animal welfare.

“Countries that are dependent on importing food from countries such as Aotearoa, like China and the UK, will increasingly be able to produce more of their own alternatives to animal protein as technology advances,” warns research lead Jon Manhire, director of The AgriBusiness Group.

The dairy sector in New Zealand is more threatened by the development of new proteins than our meat producers, found the research.

The Protein Future Scenarios research team modelled the economic and environmental implications of three plausible future scenarios based on different rates of technological advancement for the main alternative protein technologies, with associated growth in consumer demand.

The worst economic scenario predicted by the research was associated with the potential growth of precision fermentation, which uses fermentation and yeasts to replicate dairy products.

The impact of increasing global demand for new proteins on New Zealand’s meat and milk industry will be higher if we don’t mitigate our agricultural greenhouse gas emissions and meet high standards for animal welfare and water quality, found the research.

This is because a desire to live more sustainably drives some people to want to eat alternative proteins, which can be marketed as having a lower greenhouse gas footprint.

What are Alternative Proteins?

Fermented Protein

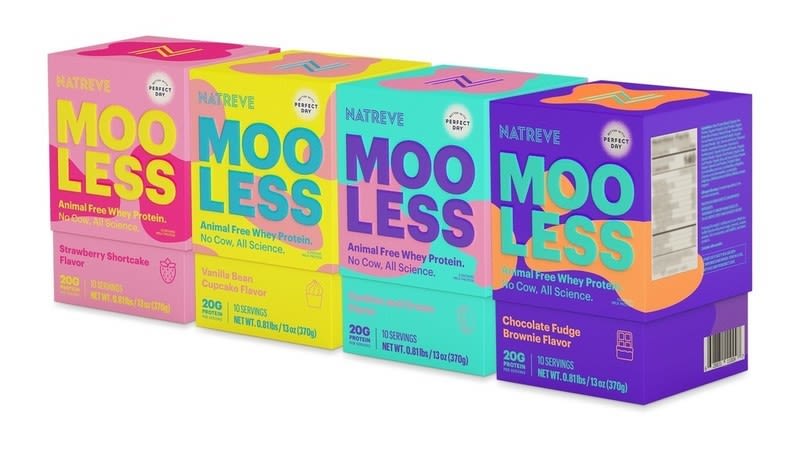

Precision fermentation uses fermentation and yeasts to replicate dairy foods. Fermentation is not used to produce meat alternatives.

Whey and rennet derived from precision fermentation are already in commercial production, and casein and milk fats can also be produced.

Fermented proteins have long historical origins, and have been made from nuts, seeds, tubers, and coconuts. There are traditional fermentation methods in te ao Māori.

Plant-Based Protein

Plant-based meat and milk alternatives are made of protein extracted from plants, legumes or grains.

This type of protein includes traditional foods such as tofu, and new technology that mimics meat by modifying protein, perhaps adding soy leghemoglobin to offer a ‘bloody flavour’.

Cell-Cultured Protein

Cell-cultured (or lab-grown) protein is created by extracting cells and replicating them in a laboratory environment. The end product is identical to the original product, having been made from the same genetic material.

This method enables the production of real meat from any species. It is not considered genetic modification.

Cell-cultured foods still await regulatory approval. Just one product is for sale in Singapore.

The Current Scenario

Scenario One (Baseline)

This scenario reflects the current situation of an increased demand for alternative protein. It assumes that the production of new alternative proteins contributes towards meeting increased demand, but only marginally impacts on traditional protein supply chains. Issues like technical barriers, issues with scaling production and lack of consumer uptake cause a slow growth in alternative proteins.

This scenario is not a likely future outcome given the current level of interest and investment, and recent technological advances. It is included to provide a point of comparision.

Three Future Scenarios

The parameters for the growth of alternative proteins in each scenario are based on published projections developed by investment consultants or academic experts (see full report for details)

Scenario Two

Precision fermentation takes off and demand for plant-based milks increases (+22%), impacting traditional dairy products.

Demand for plant proteins continues (+10%) but technical issues stall the development of cellular products.

Sustainability is one factor driving consumer acceptance, in addition to improved taste and texture, and price parity.

Scenario Three

Plant-based products take off, while some of the barriers facing precision fermentation and cellular products are removed.

There is increasing demand for plant protein (+22%), precision-fermented dairy (+10%), and cell-cultured protein (+10%).

Sustainability is a key factor driving consumer acceptance.

Scenario Four

All alternative proteins take off. There is a significant increase in demand for plant protein (+22%), precision-fermented dairy (+22%), and cell-cultured protein (+22%).

All current barriers to the success of alternative proteins have been removed or are in the process of being overcome. Scale of production increases, and price parity is achieved. Taste and texture improve.

Sustainability is a significant factor. Alternative proteins are viewed as solving several global concerns.

What Will 2050 Look Like?

Demand for proteins is expected to increase globally due to population growth and changing diets.

This is unlikely to drive increased production from New Zealand's animal protein sector. The increased demand could be met by alternative proteins, suggests the research.

The research models showed that alternative proteins may have a relatively minimal impact on New Zealand agriculture when projected over the next decade. Significantly greater impacts were identified when the modelling horizon was extended to 2050. Although long-term predictions are more approximate, the research shows the likely trend in direction.

Environmental Impact

Greater global demand for alternative proteins will have environmental benefits for New Zealand.

Scenario 1 provides the baseline prediction for greenhouse gas emissions from agriculture in Aotearoa in 2050, based on our current mix of land uses.

Greenhouse gas emissions are reduced by 28% in Scenario 4, in which demand for all alternative proteins takes off and technological barriers are removed.

Land-use change modelling indicates this scenario would reduce the size of the pastoral farming sector in Aotearoa, and increase the area of land used for arable farming and forestry.

All three future scenarios forecast reductions in nutrient loss due to land-use change. Reductions are estimated to range from a reduction in nitrogen loss of 6% to 17%, and a reduction in phosphorus loss of 2% to 18%.

Economic Impact

Greater global demand for plant protein will also have economic benefits for New Zealand, but these will be unevenly distributed.

The worst economic scenario for New Zealand predicted by the research was associated with the potential growth of precision fermentation, which uses fermentation and yeasts to replicate dairy products.

The research suggests that this scenario would likely lead to decreased output for our dairy sector nationwide, due to the increased availability of dairy product substitutes.

The flow-on impacts of this would drop New Zealand's economy and employment by around 9%, found the modelling.

Scenario 4, in which the technological barriers to cell-cultured protein are resolved, is likely to have negative economic impacts on the New Zealand meat sector.

However, scenarios 3 and 4 both show an overall increase in economic output of around 7% and a similar increase in employment (plus environmental improvements) compared to the baseline scenario. In both these scenarios, there would be a shift in land use towards arable and forestry production.

"If widespread availability of cheap alternative proteins reduce profits for our beef, sheep and dairy farmers, we're likely to see land-use change into arable, horticulture and carbon farming. This will have positive economic benefits for those sectors, but would reduce the size of our pastoral sector."

Regional Analysis

Regional economic outlooks were developed for the scenarios. These include impacts over time on employment, land use, and environment, to inform long-term planning and regional development.

For example in Canterbury, a scenario for 2050 in which all alternative proteins take off has the potential to decrease greenhouse gas emissions by over one-third, and decrease nitrogen loss by almost 15% while increasing economic output 15% with a shift of some intensive dairy to horticulture and arable land use.

However on the West Coast, there is a negative economic outcome. This is also due to a contracting dairy sector, but in a region where there are thought to be fewer land-use options.

Economic outlooks were developed for the four scenarios for each of New Zealand's 16 regions, and are available on request.

Timeline

Click the arrow on the right to navigate the timeline

Policy Issues

A national policy or strategy is needed to help New Zealand prepare for the risks and potential opportunities of new proteins, say experts in the New Zealand meat and dairy export industry who were involved in the research.

Most experts interviewed as part of the research agreed the results reflected the impact they expect from increased production of alternative proteins.

We Must Reduce Agricultural GHGs

The negative impacts of increasing global demand for new proteins on New Zealand’s meat and milk industry will be significantly higher if we don’t mitigate our agricultural greenhouse gas emissions.

This is because a desire to live more sustainably drives some people to want to eat alternative proteins, which can be marketed as having a lower greenhouse gas footprint.

New Industries Will Emerge

New Zealand has the opportunity to become a major producer of alternative proteins. Significant quantities of renewable energy are needed, and New Zealand’s supply of hydro and increasingly wind power put us in a good position.

Māori knowledge of traditional fermentation practices is currently untapped.

Producing large quantities of protein through precision fermentation and cell-culture processes will require a massive supply of inputs such as serum and yeasts, and this emerging ‘feed industry’ could also provide opportunities for Aotearoa.

Prepare for Market Shifts

New Zealand needs to prepare for significant changes to our key food export markets.

Countries previously dependent on importing food from Aotearoa, including China and the UK, will be able to produce more of their own proteins as technology for producing alternatives to animal protein is adopted.

The dairy sector in New Zealand is more threatened by the development of new proteins than our meat producers. Fonterra’s response of engaging with the sector is sensible.

This findings this research summary is based on were generated by the following researchers: Jon Manhire (project lead, The AgriBusiness Group); Dr Christopher Rosin (science lead, Lincoln University); Prof Hugh Campbell, Prof Miranda Mirosa, Dr Simon Barber (University of Otago), Prof Rob Burton, Prof Klaus Mittenzwei (Ruralis, Norway); Dr John Reid (Ngai Tahu Research Centre, University of Canterbury); Stuart Ford, Sarah O`Connell, Kate Tomlinson, Ann Moriarty (The AgriBusiness Group); Angus Sinclair Thompson, Brent Paehua (Centre for Sustainability, University of Otago); Dr John Saunders (AERU, Lincoln University). Summary by Annabel McAleer.

This work was funded by the New Zealand Ministry for Business, Innovation and Employment’s Our Land and Water National Science Challenge (Toitū te Whenua, Toiora te Wai), contract C10X1901, as part of the Protein Future Scenarios programme.